San Jose, Austin, Seattle and Pittsburgh Have the Highest Percentage of Potential Millennial Homebuyers

An increasing number of millennials, those born from 1981 to 1996, are in or are approaching their first-time homebuying years. Older millennials, meanwhile, are in the age-range for a move-up purchase. According to the CoreLogic® Loan Application Database[1], millennials made up 67% of first-time home purchase applications and 37% of repeat home purchase applications in 2021.[2]

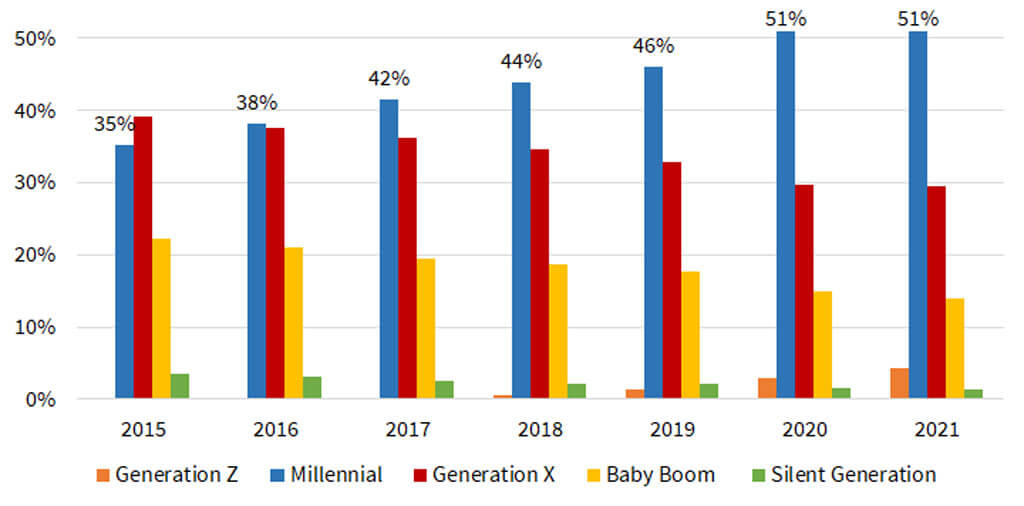

Millennials have made up the largest share of home purchase mortgage applications since 2016, accounting for 51 percent of home-purchase mortgage applications in 2021, up five percentage points from 2019 (Figure 1). However, the share varies across individual housing markets. Our previous studies have shown that homebuyers’ choices were affected by home affordability, employment opportunities, flexibility to work remotely, local tax rates and preference for open spaces.[3] In general, millennials have more buying power in affordable markets compared to high-cost areas. Nonetheless, our data shows their share is much higher in some high-cost metros as well, especially areas with high-tech job opportunities.

Figure 1: Millennial Home Purchase Applications Share Largest Since 2016

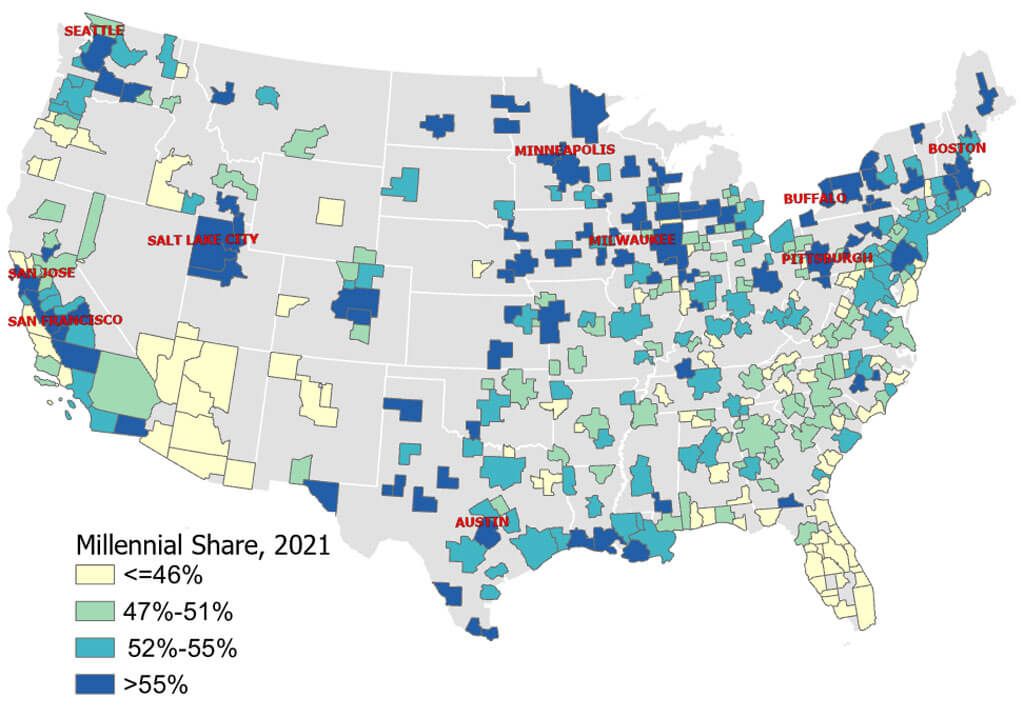

Figure 2 shows the U.S. metros based on their millennial application share in 2021. Millennials made up a higher share of the potential homebuyers in the Midwest markets and in metros with high-tech job opportunities. San Jose, California, had the highest percentage of millennials applying for a home mortgage (64%), followed by Austin (61%), Seattle (61%), Pittsburgh (61%), Boston (60%) and San Francisco (60%).[4] Salt Lake City, Milwaukee, Minneapolis and Buffalo were also among the 10 metros with the highest percentage of millennial applicants. These metros with highest share of millennial applicants either offer high-tech job opportunities or affordability.

Figure 2. U.S. Metro Areas Based on Share of Millennial Homebuyers in 2021

Midwest Metros and Metros with Higher Technology Employment had a Higher Share of Millennials

Conversely, metros in Florida and Arizona had the lowest percentage of millennials applying for a home mortgage. Miami and Las Vegas had the lowest percentage (43%), followed by Orlando (44%), Tampa (44%), Phoenix (45%) and Jacksonville (45%).[5]

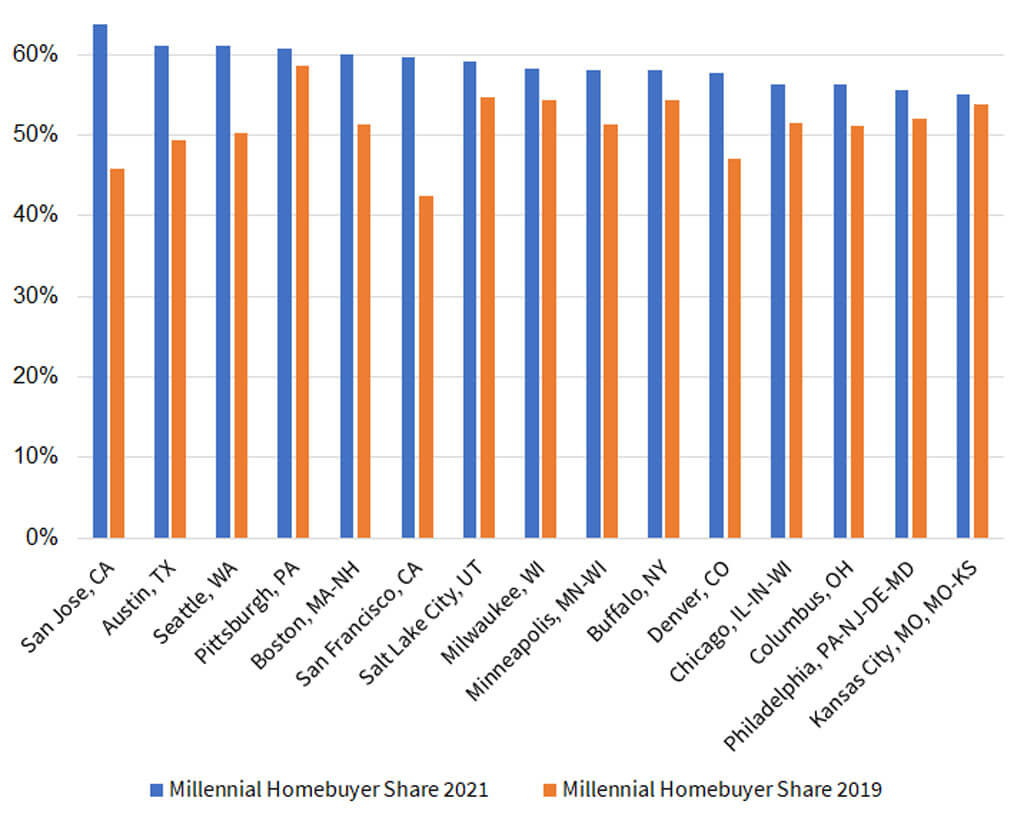

In addition, metros with a higher share of high-tech jobs saw an increase in millennial homebuyer share from 2019. Figure 3 shows share of millennials for the top 15 metros in 2021, compared to same period in 2019. Some high-cost metros such as San Jose, San Francisco and Seattle that offer high-tech job opportunities experienced a higher increase in millennial share over the two-year period. In contrast, affordable metros such as Pittsburgh, Salt Lake City, Milwaukee and Buffalo experienced only a small increase in millennial homebuyer share.

Figure 3: Top 15 Metros with Highest Millennial Home Purchase Applications Share

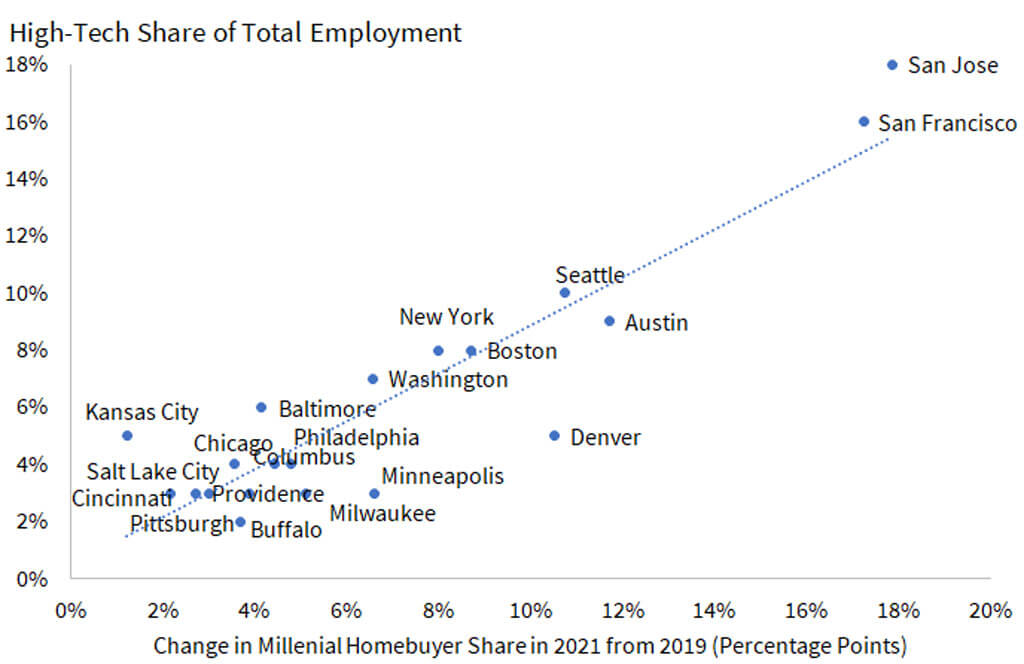

Figure 4 plots the change in share of millennial homebuyers against the high-tech share of total employment for the top 20 most populous metros in 2020.[6] There is a positive relationship between the change in millennial share and high-tech employment share. To be noted, millennial homebuyers in San Jose, San Francisco and Boston had the highest average credit scores, highest average income and made a bigger down payment. This could be a result of higher wages among high-tech industry jobs, which have been attracting millennials. In the meantime, the older generation homebuyers are selling their houses and moving to lower-cost metros with warm weather and amenities, which reduces their share in the high-cost areas. Thus, the millennial buyer share is higher in high-tech metros (such as San Jose, San Francisco and Boston) and lower in Florida and Arizona metros.

Despite affordability challenges for many potential millennial homebuyers, especially in the high-cost market, millennials with high-tech skills whose compensation is commensurate with local living costs can buy homes. Declining numbers of older generation homebuyers is contributing to change in the ratio as well, because as older generation buyer share declines, millennial share rises.

Figure 4. Millennial Homebuyers Share Increased More in Metros with Higher Share of High-Tech Employment

[1] This analysis is based on all home-purchase mortgage applications, accepted or not, from January 2021 to August 2021. Investors and second-home buyers were excluded in the analysis.

[2] Gen Z, the cohort succeeding millennials (born after 1996), made 8% of first-time home purchase applications.

[3] Also, see our report “2020 CoreLogic Hottest Cities for Homebuyers Report”

[4]Out of the top 50 metros based on 2020 population.

[5]Out of the top 50 metros based on 2020 population.

[6] High-tech share of total employment in area is based on 2019 data.